A practical Debt Payoff Tracker serves as a vital tool for understanding your balances and staying focused on your monthly financial goals. Facing debt is much more manageable when you can see a clear path forward, rather than guessing your next move. In this article, I have put together 12 different spreadsheets and printable options to help you log every payment and interest rate. Whether you want a complex spreadsheet with automated math or a simple paper log for your desk, these tools make it easier to stay consistent and watch your progress as your loans disappear month after month.

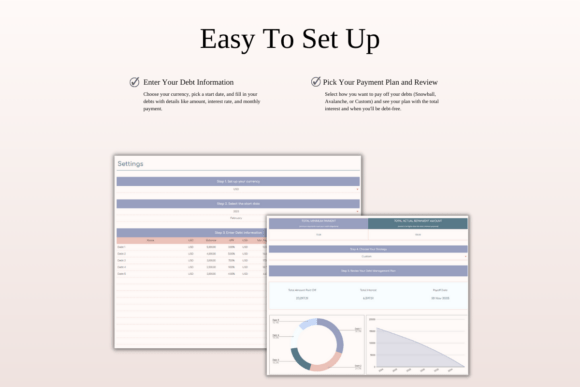

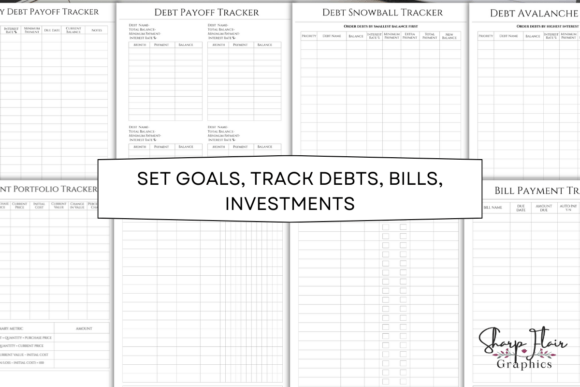

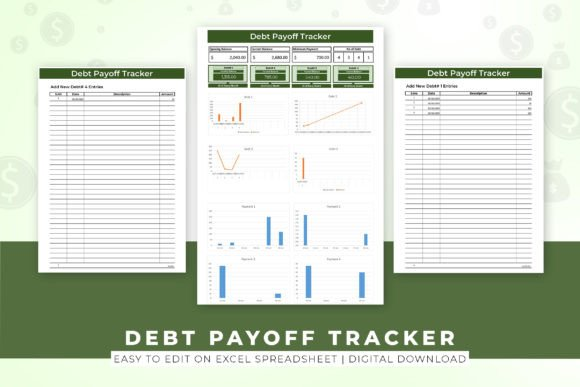

1. Debt Payoff Tracker Excel & Google Sheet

I used to feel stuck with my bills, but this Debt Payoff Tracker keeps me moving forward. I can use the snowball method for quick wins or the avalanche strategy to minimize interest. Because it is a flexible Google Sheet, I just update it on my phone while on the go. It handles 50 debts over years, and seeing my payoff date get closer every month is such a relief.

The dashboard and automatic calculations in Excel take away all the math-related stress for me. Everything from interest tracking to progress journals is right there. You get four versions, including samples with mock data. It works on any device, so I keep my financial plan consistent from my laptop to my phone without any headache or setup issues.

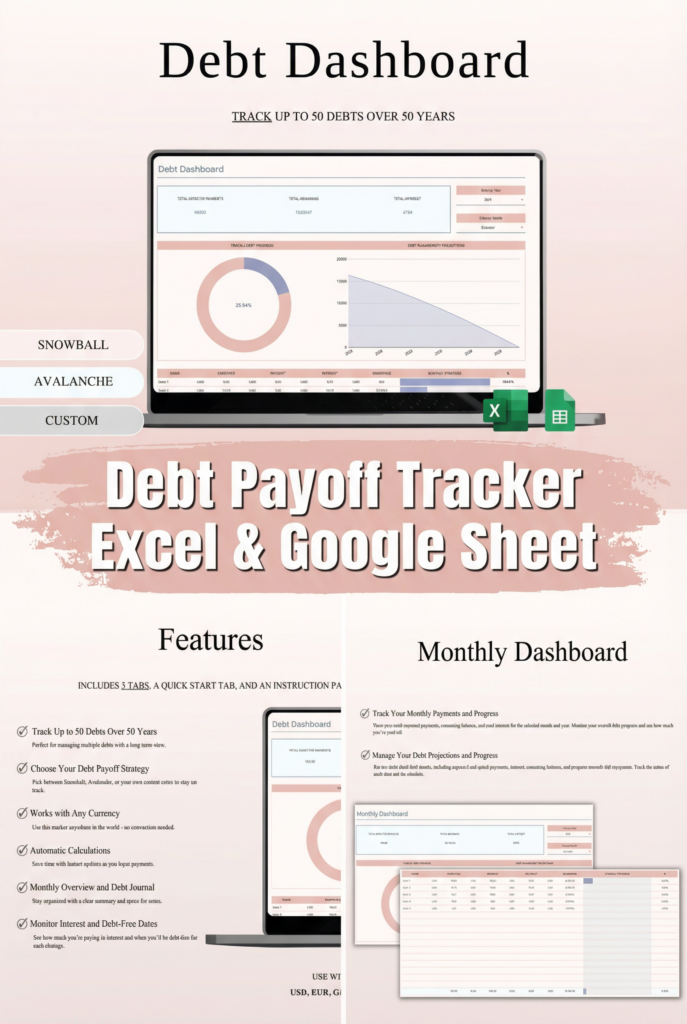

2. Mega Personal Finance Planner Bundle

I finally got my habits sorted with this Mega Personal Finance Planner Bundle. My favorite part is definitely the Debt Payoff Tracker because it helps me visualize how each payment chips away at my loans. I usually use the snowball version for quick wins, but it’s nice having the avalanche option too. It is perfect for US Letter size, so I just print pages for my binder or edit the Canva templates on my phone when I am busy.

The variety in this Mega kit is great; I am tracking my net worth and subscriptions without any stress. Since this Personal Finance set is editable, I customized the colors to stay motivated. Having a single Planner Bundle means I don’t need a dozen different apps. From my emergency fund to tax docs, everything stays organized in one place, so I can see my whole financial picture mapped out clearly.

3. Digital Budget Planner, Financial Planner

I’ve been using this Digital Budget Planner on my iPad, and the 10,000+ hyperlinks make moving around so fast. I can jump to any section with just two taps. My favorite part is the integrated Debt Payoff Tracker where I manage my student loans and watch the balances drop. It is a clean, minimalist Financial Planner that keeps all my monthly numbers perfectly organized in one file.

I also really enjoy the specific savings challenges for things like car repairs and vacations. Every month includes spending logs and a budget breakdown to keep my cash flow clear. It works flawlessly in GoodNotes, and the 200 stickers make planning sessions fun. It is exactly what I needed to stay accountable without feeling overwhelmed by messy paperwork.

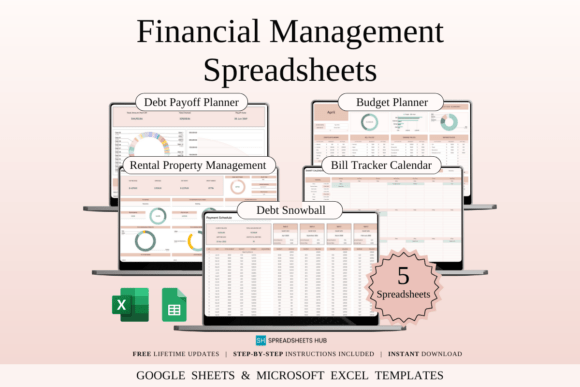

4. Financial Management Spreadsheets

I recently moved my budget over to these Financial Management Spreadsheets, and it’s been a relief. The package features an elegant Debt Payoff Tracker that helps me see my loan progress without any visual clutter. I rely on the snowball strategy sheet for small wins and the bill calendar to keep my payment dates clear. Because there are 20 different Spreadsheets included, I can even manage my rental properties and household bills using the same style.

Everything works perfectly in both Excel and Google Sheets, so I can check my progress on my phone or laptop. The design is modern and polished, making my daily money tasks feel more organized and less like a chore. Using the sample sheets with mock data made it so easy to get started, letting me focus on my savings instead of wrestling with complex formulas.

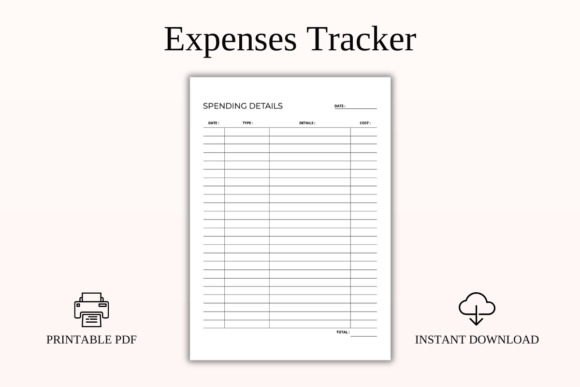

5. Expense Tracker Printable PDF Template

I personally prefer keeping a paper trail when managing my monthly bills. This Expense Tracker Printable allows me to see every single cent that leaves my pocket without opening an app. I use it alongside my physical Debt Payoff Tracker binder to make sure my loans are being handled. Having this PDF Template in sizes like A5 and US Letter is a lifesaver, as I can slip the logs into my favorite daily planner.

What I love most is the minimalist design; there is no clutter, just space for dates, categories, and totals. This Template is ready to print at home, so I never run out of pages for my spending logs. It fits perfectly into my cash envelope system, making my financial habits much more tangible. If you enjoy the feeling of writing down your goals, this is a very practical, low-tech way to stay organized.

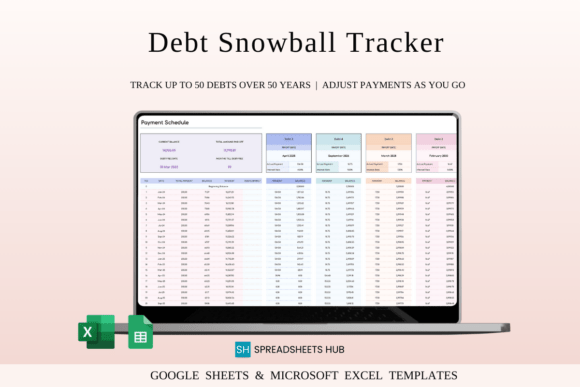

6. Debt Snowball Tracker Template Excel

I started using this rainbow Debt Snowball Tracker because I needed a way to manage my balances without the usual stress. The Excel layout focuses on small wins first, which keeps me motivated as I check items off my list. It handles dozens of accounts at once, making it a solid choice if you need a reliable Debt Payoff Tracker that doesn’t feel clinical or boring.

The dashboard in this Template updates automatically, so I always know exactly when I will be done. I appreciate that I can use it across any device and it handles any currency. Having a visual map of my progress takes the guesswork out of my monthly payments. It’s simple, colorful, and makes organizing my finances feel like a manageable project instead of a burden.

7. 2026 Money Savings Challenge Canva

I’m already getting ready for next year with this 2026 Money Savings Challenge kit, and it’s actually fun. Even though the main focus is Savings, I use these trackers alongside my Debt Payoff Tracker to stay on top of every goal. These Canva templates come with 30 pretty designs, including a 52-week Challenge. The 6×9 size is just right for my favorite planner binder.

The PDF files are very high resolution, so I printed them to use with my cash envelopes. I really love coloring in the little icons as I save; it makes my progress feel much more tangible. Having this visual Money plan ready to go makes me feel organized and prepared for the year ahead. It’s a simple way to keep my daily habits visible right on my desk.

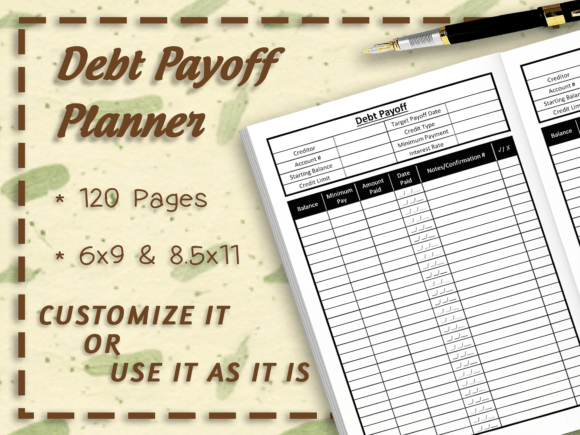

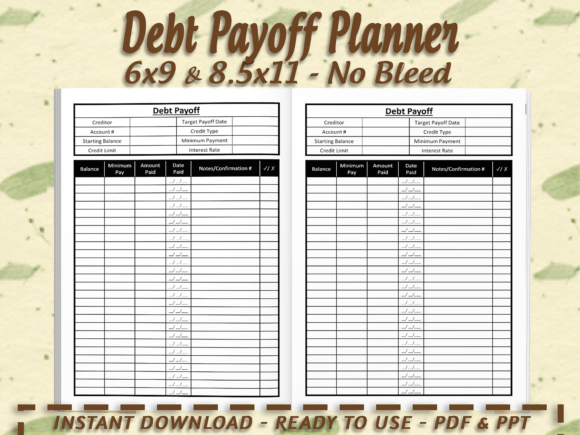

8. Debt Payoff Planner 120 Pages

I’ve been carrying this 120 Pages workbook around, and it has genuinely helped me sort out my messy financial thoughts. Using a physical Debt Payoff Tracker means I can finally stop keeping everything in my head and actually see the progress on paper. I write down every single balance and date, making sure nothing slips through the cracks while I navigate my journey to being debt-free.

The Debt Payoff Planner comes in two sizes, but I prefer the smaller version that fits right in my purse. Because it is editable in PowerPoint, I can even adjust the fonts and layout to fit my own personal style. Tracking my Debt this way keeps me honest and consistent with every payment without any digital distractions. It is just a straightforward, tangible way to watch my numbers change month by month.

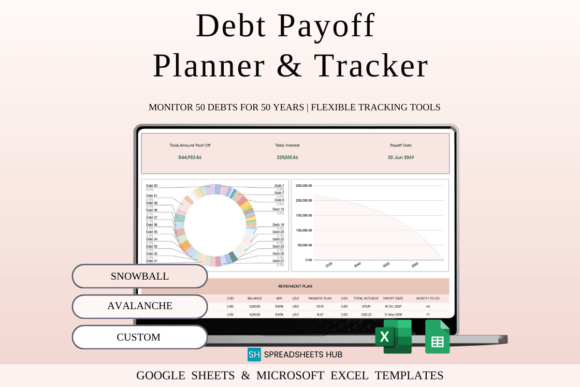

9. Debt Payoff Planner & Tracker

I’ve been using this Debt Payoff Tracker to manage my balances, and it feels great. The spreadsheet lets me switch between the snowball or avalanche method to see which one works faster for my situation. With this Planner, interest rates and payoff dates calculate automatically, giving me a clear picture of my financial timeline without any guesswork or math-related stress involved.

Since it works in Google Sheets, I update my Tracker on my phone while I’m out. The package has four versions and some samples to help me get started immediately. It’s a flexible way to see my interest savings grow without doing any difficult formulas myself. Having all my accounts in one spot helps me keep up with payments without ever losing focus on my long-term goals.

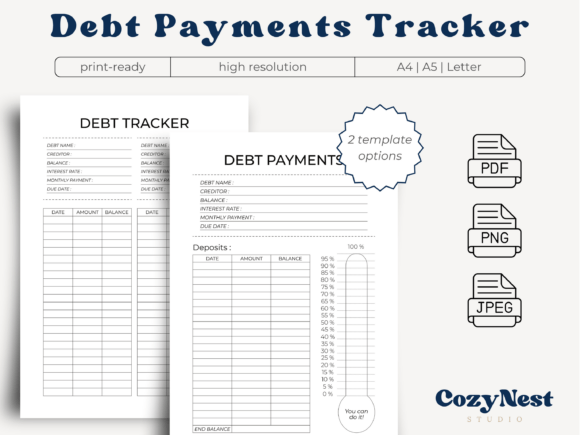

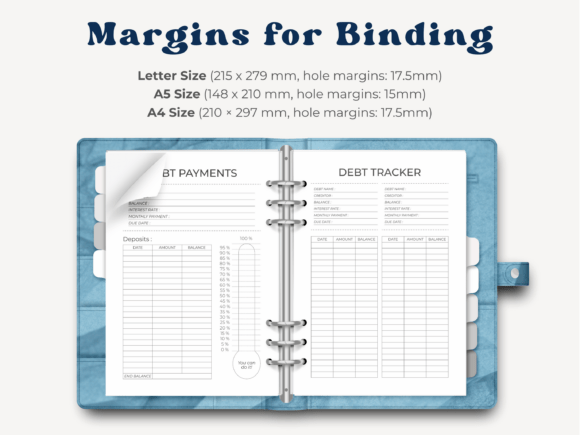

10. Debt Payments Tracker Printable & Digital

I started using these paper logs for my loans, and it makes my planning much simpler. I downloaded the Debt Payments Tracker and printed the A5 version for my binder. I usually flip between the standard sheet and the snowball one to see my progress. Since they have wide margins, they don’t get cut off when I punch holes. It’s a great way to watch my numbers drop without using an app.

This Printable Digital kit comes with high-quality PDFs and images. Having a dedicated Debt Payoff Tracker right in front of me keeps my spending in check. It’s handy that it includes Letter size for my desk folder. Writing every payment by hand feels satisfying and helps me stay consistent until my balances are finally gone.

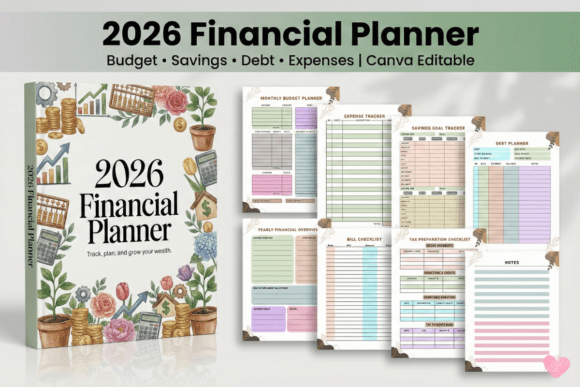

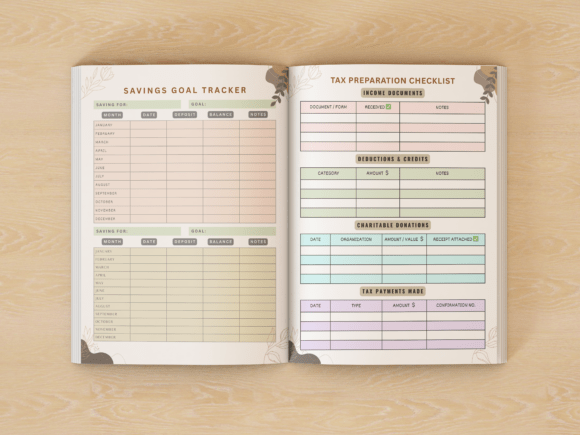

11. 2026 Financial Planner

I am mapping out my whole upcoming year with this 2026 Financial Planner. It’s much more than just a list of numbers; I use it to keep my daily spending and investment logs in check. The part I rely on the most is the integrated Debt Payoff Tracker because it lets me log interest rates and payoff dates in a clear way. Since it has 120 pages, there is plenty of room for my monthly budget breakdowns and recurring bill checklists.

This 2026 tool works perfectly for my daily routine since I prefer having a physical Financial Planner on my desk. I’ve already customized a few pages using Canva to make the tax prep checklists suit my specific needs. Having everything from my income sources to my savings goals in one place keeps my mind clear. It’s a simple, paper-based method to see where every dollar is going without needing any complex software.

12. Debt Payoff Tracker Green

I’ve been using this Debt Payoff Tracker Green edition to handle my credit cards and car loan, and it keeps things incredibly clear. Since it functions as a Google Sheets spreadsheet or Excel file, I log my numbers from my phone or laptop whenever I make a payment. I specifically use the snowball section because paying off small balances first helps me stay focused. The clean green dashboard shows my totals automatically, so I can stop worrying about the math and start focusing on my actual progress.

This Tracker comes with a monthly calculator and an instant download, so I started my plan immediately. I just entered my starting balance and interest rates, then let the sheet figure out my repayment dates. It is perfect for keeping an eye on a student loan or mortgage without feeling overwhelmed by data. Having my entire Debt plan in one professional Green template keeps me organized and much more confident about my financial future.

Parting Thoughts

Navigating your path to financial freedom is a personal process, and the system you use should fit your unique habits. These 12 options provide the flexibility to use the snowball method for quick wins or the avalanche strategy for interest savings. Take a moment to pick the specific layout that matches your routine, whether that involves updating a digital file on your phone or writing in a physical planner. Keeping your progress visible is a highly effective way to remain accountable, ensuring that every payment brings you one step closer to finishing your journey for good.

Other Useful Finds

Best Personal Finance Planners for 2025 (Digital, Analog & Free!)